If you didn’t get a pay rise of at least 2.7% in the last year, you got a pay cut

Real vs nominal

Last week, the Bureau of Labor Statistics (BLS) released its numbers for inflation in November. They showed that “The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent on a seasonally adjusted basis in November, after rising 0.2 percent in each of the previous 4 months.” Over the linger term, “The all items index rose 2.7 percent for the 12 months ending November, after rising 2.6 percent over the 12 months ending October.”

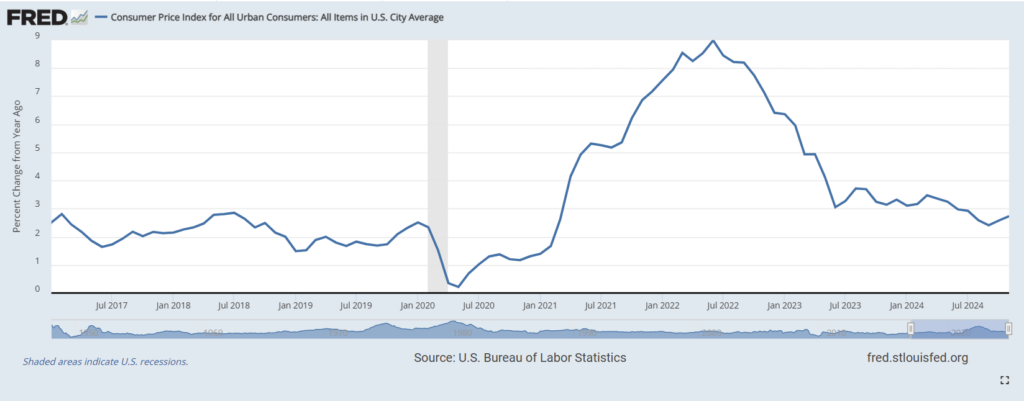

As Figure 1 shows, after falling sharply from its June 2022 peak of 9.0% to 3.0% in June 2023, the annual rate of increase of the CPI – the commonly reported rate of inflation – has stopped falling. Indeed, the average rate since then, 3.1%, is a full percentage point above the rate – 2.1% – which prevailed over the period from President Trump’s inauguration in January 2017 to the inset of the COVID-19 pandemic in February 2020.

Figure 1

This final round of the Fed’s fight against inflation is proving to be the hardest. Either way, with prices up by 2.7% over the last year, if you didn’t get a pay rise of at least 2.7%, you got a pay cut.